What is income tax and who has to file a tax declaration in Germany?

Who is required to file a tax return and who is not? Can a tax return be filed voluntarily? Who can claim what costs? Is there a deadline that must be met, and what forms are needed at all? The following article will answer these questions.

In the text, we will use some technical terms from German tax law that you will encounter when dealing with the German tax authorities / the tax office. It is therefore important that you have seen or read these terms before. But don't worry – we will always explain and translate the terms!

Inhalt

- When and for whom is filing a tax return mandatory?

- When is the submission of an income tax return obligatory for employees in Germany

- Who is subject to limited tax liability (183-day rule)?

- When is a voluntary income tax return worth the effort?

- Which are the 10 most important income-related expenses & lump sums in the tax return?

- Which are the most important forms for the income tax return?

- Tax return Germany deadline 2025

- Important German tax return terms at a glance

When and for whom is filing a tax return mandatory?

If your income exceeds the basic tax-free amount of 11,784 euros for the tax year 2024 (or 23,568 euros for married couples taxed jointly), it will be taxed (2025: 12,096 euros/24,192 euros). The amount of income tax ultimately paid depends on the amount of income.

Employees pay income tax every month, which is automatically deducted from their salary. The submission of an income tax return is therefore no longer mandatory for employees.

Tip You can find more information and a detailed English-German tax dictionary in our tax guide: Tax Return: A step-by-step guide to file your taxes in Germany. It was created for all employees who want or need to file a tax return in Germany.

However, there are certain circumstances in which you may be required to file a tax return. For example, if you have other income in addition to your main job (e.g. wage replacement benefits such as short-time work allowance or childcare allowance) or if you claim tax-free allowances.

When is the submission of an income tax return obligatory for employees in Germany?

For employees in Germany, the employer automatically deducts the income tax from the salary each month and forwards it to the tax office. However, if other income is added to the main income, if there are certain tax class combinations or other special features, the submission of an income tax return may be mandatory. In such a case, the state fears that too little income tax has been paid even though wage tax has been paid. The obligation to file a tax return for employees is regulated in § 46 of the Income Tax Act (Einkommensteuergesetz, EStG).

Employees in Germany must file a tax return for a particular tax year if:

- Incidental income of more than 410 euro was earned, which is not subject to wage tax deduction,

- tax allowances were claimed when deducting wage tax (e.g., for income-related expenses, extraordinary expenses, special expenses, etc.),

- more than 410 euro in top-up contributions for partial retirement, unemployment, sickness, short time working, insolvency, parental or maternity benefits were received, which are subject to the progression proviso,

- several employment relationships with different employers existed in parallel and were settled according to tax class VI,

- both spouses receive wages and the tax class combination III/V or IV/IV with factor was entered,

- married, divorced or permanently separated parents do not split the education allowance or the disability allowance in half or claim it in a ratio other than 50% each,

- one of the spouses has died or the marriage has been divorced and one of the spouses has remarried in the same year,

- a spouse living abroad in the EU was included on the electronic income tax card,

- the place of residence or habitual abode is abroad and unlimited tax liability has been applied for in Germany,

- there is capital income for which no final withholding tax could be levied,

- there is capital income for which no final withholding tax could be levied,

- taxable income exceeded the basic tax-free amount, although no salary was received,

- a loss carryforward (Verlustvortrag) was claimed.

- An income tax return must also be submitted if the tax office requests it.

Who is subject to limited tax liability (183-day rule)?

Individuals who are resident or ordinarily resident in Germany are subject to unlimited tax liability. People who are not ordinarily or habitually resident in Germany are subject to limited income tax liability.

At least if they earn taxable income according to Section 49 of the Income Tax Act. This includes, among other things, income from renting, leasing or selling or income from non-self-employed work.

When is a voluntary income tax return worth the effort?

If you are not obliged to file an income tax return, you can still do so on a voluntary basis. Especially in the case of high income-related expenses, special expenses or if the tax class has changed for example, if you married (from tax class III/V to IV/IV), the tax return may well be worth the effort. On average the refund was 1,095 euros in recent years.

Voluntary income tax return for employees in Germany

The tax authorities give employed persons a whole range of options for claiming varying income and expenses for tax purposes. These include:

- Income-related expenses,

- special expenses,

- extraordinary expenses,

- expenses for household-related services,

- entitlement to child allowances,

- Insurance premiums paid above the lump-sum pension allowance,

- variable salaries within one year,

- change of tax class (e.g. through marriage) or tax class IV without factor.

It might also be worthwhile to file a tax return for those who received a severance payment without applying the one-fifth rule or who did not work as an employee for the whole year.

Which are the 10 most important income-related expenses & lump sums in the tax return?

The former German Chancellor Helmut Schmidt once said: "Those who have the duty to pay taxes also have the right to save taxes". We take this statement as an opportunity to point out the 10 most important income-related expenses and lump sums for taxpayers that reduce the tax expense:

- Travel expenses to the first place of work

- Bank account management fees

- Application expenses

- Contributions to statutory and private pension insurance

- Contributions to health, nursing care, liability and accident insurance

- Household-related services & handymen's services

- Child allowances

- Relief amount for single parents

- Old-age relief amount

- Medication and treatments that were medically necessary and appropriate and whose costs were not covered by the health insurance fund.

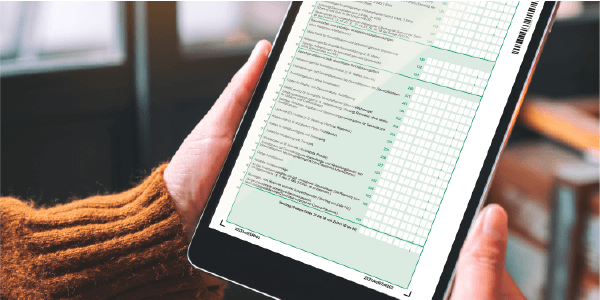

Which are the most important forms for the income tax return?

Anyone who must or wants to file an income tax return for the first time can quickly lose track of the numerous forms. Which forms do you have to fill out at all and what should you include? Even if it takes some time and patience to get an overview, the forms are important. After all, they give taxpayers the opportunity to apply for tax relief or to declare special types of income or expenses.

Tip We focus here on the most important attachments. All forms can be downloaded free of charge here in the service area.

Attention: The forms for the tax declaration are (unfortunately) only available in German.

Cover Sheet (Mantelbogen or officially: Hauptformular ESt 1 A)

The cover sheet is the first form in the tax return and the basic structure of every income tax return. It comprises a total of two pages and must not be omitted under any circumstances. Personal data such as name, address, marital status, religious affiliation, bank details and the tax identification number are entered in the cover sheet. In addition, it can be noted whether the tax assessment is single or joint or whether a community of property has been agreed.

Covering Sheet (in German: »Mantelbogen« or officially: Hauptformular ESt 1 A)

Annex N - Non-self-employed work (Anlage N)

If you have an occupation that is subject to social security contributions, you have income from non-self-employed work and must fill out Annex N. The tax return must be completed by the taxpayer. In addition to information on wages, taxable pension payments or tax-free expense allowances, income-related expenses can also be entered. These include, for example, travel costs (distance allowance) for journeys between home and the first place of work, travel costs, expenses for work equipment or the home office as well as further training costs.

Annex N (in German: »Anlage N«)

Annex N-Double Household (Anlage N–Doppelte Haushaltsführung)

In the case of double housekeeping, the taxpayer maintains a second home at the place of work in addition to the home where they live or where their family lives.

In most cases, double housekeeping occurs when the employee is transferred or takes up a new job outside their place of residence. Double housekeeping is also recognised if the previous main home is moved away from the place of employment and the taxpayer rents a second home at their place of employment or makes their previous main home at the place of work their second home.

Taxpayers can claim expenses incurred as a result of double housekeeping as income-related expenses on their income from employment. Alternatively, the employer can reimburse the additional expenses incurred tax-free.

Annex N-Double Household (in German: »Anlage N-Doppelte Haushaltsführung«)

Pension expenses annex (Anlage Vorsorgeaufwand)

All insurance contributions for old-age provision are entered in the annex »Vorsorgeaufwand«. In addition to contributions to statutory health, long-term care and pension insurance, details can also be entered for income or occupational disability insurance, liability insurance or accident insurance. The contributions can then be claimed as special expenses to reduce tax.

Caution: Contribution refunds from the health insurance fund are offset against the contributions for statutory health insurance. This reduces the special expenses deduction. Unlike contribution refunds, however, premium and bonus payments from statutory health insurance do not increase the tax expense. If the tax office considers premium and bonus payments to be special expenses, it is advisable to file an objection and refer to this ruling of the Federal Fiscal Court: BFH, 27 August 2020, X R 16/18.

Pension Expenses Annex (in German: »Anlage Vorsorgeaufwand«)

Annex AV - old-age provision (Anlage AV – Altersvorsorge)

The contributions for certified old-age provision contracts (e.g. Riester or Rürup pension) can be claimed as special expenses with the AV annex.

Attention: Since the end of 2019, Riester providers are legally obliged to electronically transmit all data required for the special expenses deduction to the tax office. This concerns not only the national insurance number and the allowance number, but also the number of contracts, contributions made and changes to the contract data. If you do not want a special expenses deduction for individual contracts, you must apply for this in the Annex AV.

Annex AV (in German: »Anlage Altersvorsorge«)

Extraordinary expenses annex (Anlage Außergewöhnliche Belastungen)

Extraordinary expenses include costs incurred due to illness or disability. These can then be claimed for tax purposes as part of the income tax return via the annex for extraordinary expenses. These include, for example, the disability allowance, the survivor's allowance or the lump-sum care allowance, or also costs for the disability-friendly conversion of a vehicle.

Extraordinary Expenses Annex (in German: »Anlage Außergewöhnliche Belastungen«)

Annex for household-related expenses (Anlage Haushaltsnahe Aufwendungen)

Expenses for household-related employment and services, care services and handymen's services can be entered in the Schedule of household-related expenses.

Annex for Household-related Expenses (in German: »Anlage Haushaltsnahe Aufwendungen«)

Child annex (Anlage Kind)

Parents who receive child benefit for their offspring or who wish to claim the tax-free allowances must fill in the child annex in their income tax return. Here, for example, childcare costs or education costs, the relief amount for single parents or school fees can be entered.

Annex Child (in German: »Anlage Kind«)

Tax return Germany deadline 2025

The deadlines for filing income tax returns in Germany vary depending on the taxpayer's status. For those who are obliged (e.g. freelancer) to file a tax return and complete it themselves, the deadline is generally the end of July of the following year.

Since the 2018 tax year, this is generally the deadline by which the tax return must be received by the responsible tax office. Anyone who misses the deadline and has already received a reminder must expect the tax office to estimate the taxable amount after a period of 15 months, to set back tax payments and then to demand them. In addition, late payment surcharges amounting to 0.25 % of the income tax due per month of late payment, but at least 25 euro per month, must be paid.

However, due to the pandemic, the submission deadlines have been extended for the tax years from 2021 to 2024, both included.

Tip For the 2024 tax return, which is filed in 2025, the deadline is July 31, 2025.

If you have your taxes done by a tax advisor or an income tax assistance association, the deadline for submitting income tax returns is generally February 28 of the year after next. However, due to the pandemic, the deadline has been extended to June 2, 2025, for the 2023 tax year.

The deadline is different for voluntary tax returns. This begins directly after the end of the tax year, but only ends after four years. The latest submission date for the tax return for 2024 is therefore 31.12.2028.

If the deadline falls on a Saturday, Sunday or public holiday, the tax office must receive the tax return on the next working day at the latest. This applies to both the mandatory and the voluntary income tax return.

Important German tax return terms at a glance

Annexes (Anlagen)

Annexes are tax forms that are submitted to the tax office together with the tax return.

Deductible expenses (Werbungskosten)

Deductible expenses, or Werbungskosten, are expenses incurred by an individual for work-related purpose in order to earn income, and they can be deducted from taxable income. Some common examples of Werbungskosten include expenses related to travel & transportation, equipment, work clothing, professional development, training, and professional memberships. It is important to note that not all expenses can be considered Werbungskosten, and the tax authorities have specific guidelines for determining which expenses are deductible.

Employee lump sum (Arbeitnehmer-Pauschbetrag)

When employed persons file their tax return, the tax office automatically deducts costs incurred for work-related reasons up to a maximum amount of 1,230 euro (since 2023) as an employee lump sum. No receipts or proof are required for this form of income-related expenses.

Extraordinary expenses (Außergewöhnliche Belastungen)

If a taxpayer has higher costs than the vast majority of taxpayers with the same income due to a disaster or illness, this is called an extraordinary expense. These expenses include, for example, care costs incurred due to illness or funeral costs.

Basic allowance (Grundfreibetrag)

The basic allowance is a tax-free annual amount. Income tax only has to be paid if the income exceeds the basic allowance.

Covering sheet (Mantelbogen or officially: Hauptformular ESt 1 A)

Every tax return begins with this tax return form. It contains, among other things, the taxpayer's personal data and bank details, tax ID and religious affiliation. In addition, the joint assessment of married couples or registered civil partnerships can be applied for on this form.

Commuting allowance / commuter allowance (Entfernungspauschale or Pendlerpauschale)

With the commuter allowance, the travel costs between home and the first place of work are claimed for tax purposes. Employed persons can deduct a lump sum per kilometre of distance from their taxes.

Special expenses (Sonderausgaben)

Special expenses are private costs that are tax-privileged by the legislator. These include, among others, donations, costs for a tax advisor, school fees or contributions to additional voluntary long-term care insurance.

Pension expenses (Vorsorgeaufwendungen)

Pension expenses are, for example, contributions to statutory pension insurance.

Joint assessment (Zusammenveranlagung)

For spouses or registered civil partnerships who opt for joint tax assessment, there is often a considerable tax advantage. At least if both partners earn different amounts.

My German Tax Return

A step-by-step guide to filing your taxes in Germany

Die wichtigsten Links